3 reasons why European brands should be selling on UK marketplaces in 2022

Brexit – in combination with the COVID-19 pandemic – has generated some uncertainty within the retail sector. Lockdowns and other restrictions changing on a frequent basis has made it difficult for brands to develop plans or strategies, particularly those that operate brick-and-mortar stores. Additionally, the arrival of Brexit has disrupted cross-border trade to some extent: new rules and regulations that have proved difficult to navigate have left many European brands wondering if it is still worthwhile to sell into the UK market.

However, although certain factors such as Brexit and COVID-19 have certainly created some new challenges for vendors, they also present fresh and unique opportunities that the most diligent of brands will be looking to take advantage of. This article will explore some of the opportunities that have presented themselves under the current circumstances, taking a deeper look into three reasons why European brands should be selling on UK marketplaces.

To begin with, the first reason that European brands should sell on UK marketplaces is due to the sheer growth that the UK ecommerce market has experienced.

Prior to the COVID-19 pandemic, the ecommerce market had already been growing steadily over time. However, as a result of the pandemic and the ensuing policy changes such as lockdowns, many brick-and-mortar stores were forced to close. This resulted in many customers who preferred traditional, physical retail stores, shifting their focus online – leading to a massive acceleration in the growth that the ecommerce market was already experiencing.

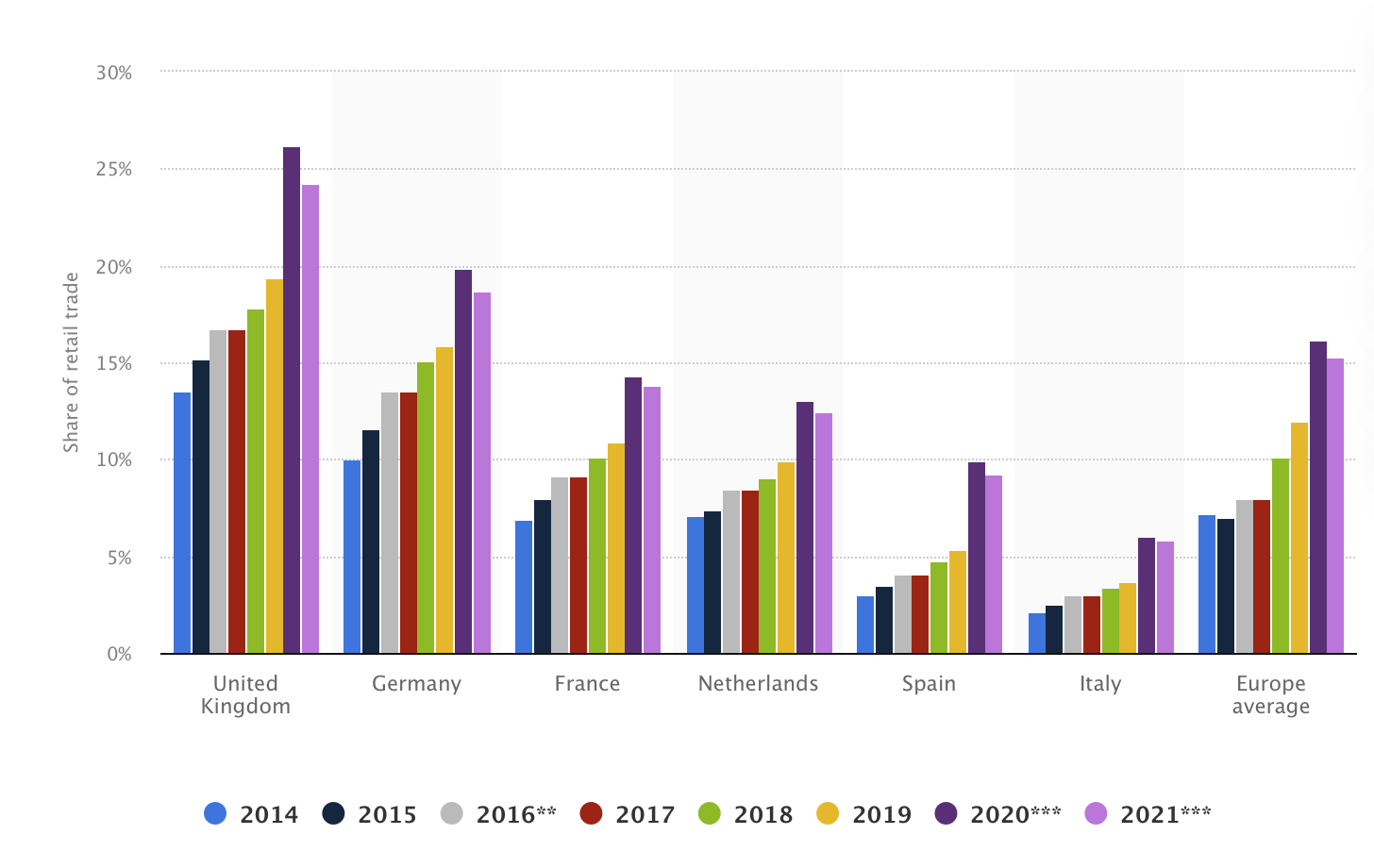

The graph above shows retail ecommerce sales as a share of the total retail trade across the UK and various European countries from 2014. As you can see, for each country, the share of retail sales that were generated online has been growing year-on-year since 2014.

In addition, there is a large spike in growth across the board for 2020, indicating the effect of the COVID-19 pandemic discussed above.

Furthermore, it is clear to see that the UK led the growth in each year. For example, in 2020, ecommerce sales accounted for 26.2% of retail trade in the UK, compared to the European average of 16.2%. This illustrates that a larger percentage of retail sales are conducted online in the UK when compared to Europe – a percentage which continues to grow over time.

This highlights the opportunity for European brands to sell on UK marketplaces, as there is clearly a sizeable consumer base to tap into.

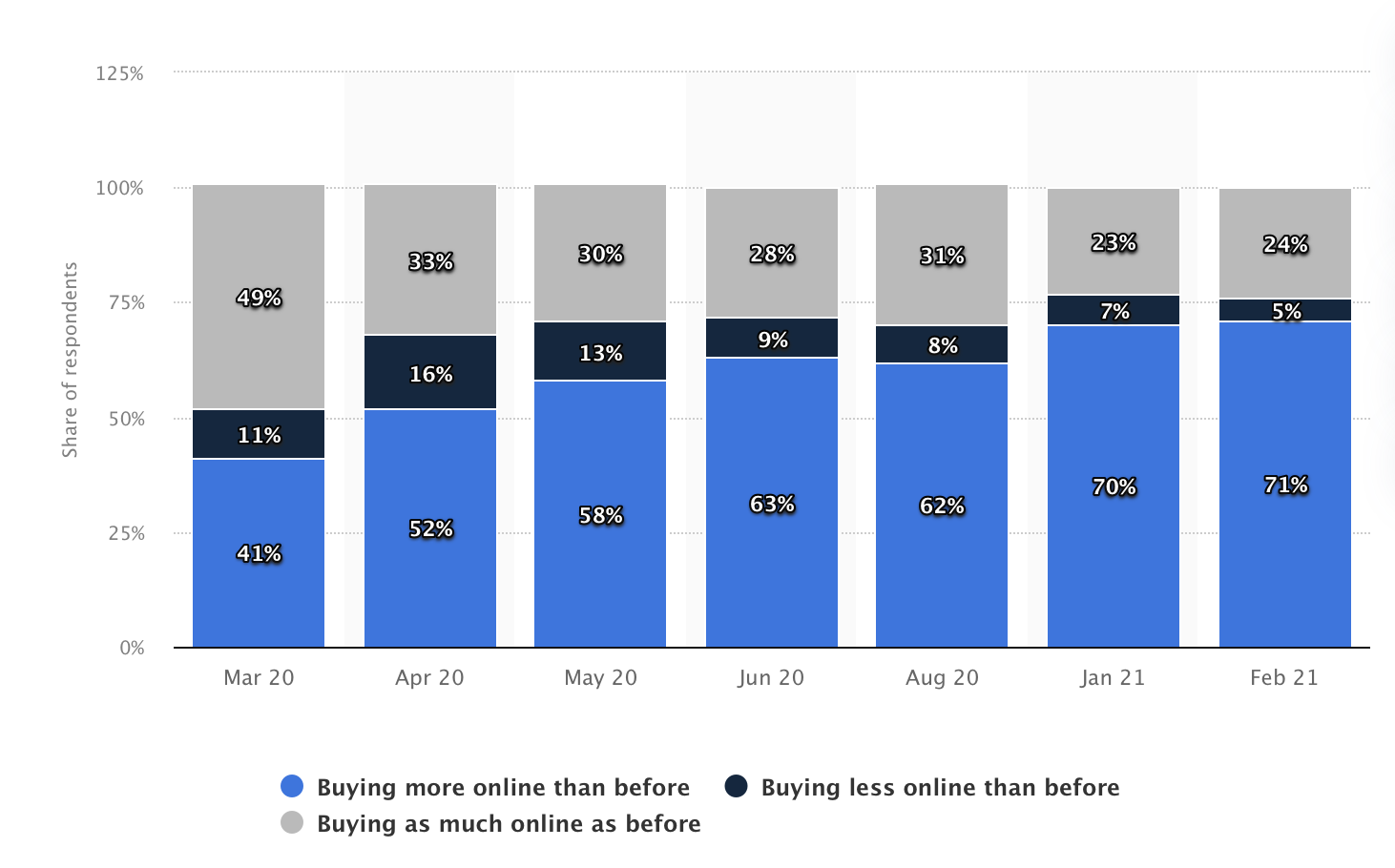

So far, we have established that in the UK, ecommerce sales comprise a higher percentage of retail trade when compared with Europe. Additionally, this has been growing over the years – and this rate of growth increased as a result of the COVID-19 pandemic, which had a massive effect on consumer behaviour. Although some consumers will have been forced to shop online due to lockdowns, it appears that many will now choose to continue doing so even after the pandemic is over.

In March 2020, for example, “about 40 percent of UK shoppers said they had been shopping more online, compared to before the coronavirus (COVID-19) pandemic.” [2] By February 2021, this figure had grown to approximately 75%. [2] This illustrates that there are a huge number of UK consumers who increased their online purchases as a direct result of the pandemic, again highlighting the opportunity for European retailers to enter the UK market.

Finally, the chart above shows the share of consumers that will primarily shop online for different categories in the future, due to the Coronavirus pandemic. For example, 64% of respondents said they will primarily shop for appliances and technology online in the future. 48% of respondents intend to do the same for apparel. This demonstrates that not only have consumer shopping habits been temporarily changed due to COVID-19, but this change could in fact be permanent – creating a lasting alteration in customer attitudes towards ecommerce in the UK.

It is clear that over the last few years there has been a digital shift that is seeing more and more retail transactions being done online, a trend that has only been accelerated by the pandemic. We have already explored some of the driving factors behind this growth, and outlined the opportunity for European merchants to sell into the UK. But another reason that European brands should be selling on UK marketplaces, is the growth of the marketplaces themselves – the middlemen that are facilitating the transactions behind much of the ecommerce growth.

One example of a UK company that has experienced this is OnBuy. Launched in November 2016, OnBuy is now the fastest-growing marketplace in the world, selling a variety of products from electronics, health and beauty all the way through to toys, home and garden. In January 2021, OnBuy recorded a massive 800% sales growth – claiming that they are on track to reach £1bn+ GMV by 2023. [4] OnBuy is just one example that demonstrates the sheer size of the UK market. Not only are we seeing an increase in retail sales, with an increasingly larger portion being online due to shifting consumer behaviour, but we also see this growth reflected in the UK marketplaces that provide a platform for buyers and sellers.

Finally, here are some other key insights into the UK market that any brand can take into consideration when developing their UK trade strategy:

- Most advanced ecommerce market in Europe [5]

- High average income

- High online penetration rate (87%) and growing [6]

- A diverse range of customers

- 25% of UK customers said they have purchased products and services online from other EU countries in the past 3 months [7]

In summary, it is clear that there is a huge opportunity for European retailers to sell on UK marketplaces. The UK has a larger percentage of retail sales occurring online when compared to Europe – this trend is only going to grow over time.

Although COVID-19 has accelerated this digital shift, it is clear that this was already happening before the pandemic and will also continue after. Finally, this growth is clearly reflected within UK marketplaces, which provide the perfect opportunity for European brands to get involved in the UK market. For a comprehensive route to market where we handle all the various aspects for you, why not work with Arcade as your merchant of record? At Arcade, we can:

- Facilitate your brand’s cross-border trade strategy in the UK and beyond

- Leverage our relationships with UK marketplaces to secure the best commercial terms

- Use our customer service network to respond to queries in the local language and time zone, taking the stress out of translation

- Design appropriate, localised product listings for your business

- Run local marketing campaigns during peak seasons and shopping events throughout the year so that you can be sure your products are reaching customers at the right time

- Handle local fulfillment and local returns of your products, so we can do the majority of the heavy lifting for you in terms of logistics

- Take care of compliance for you, using our existing partnerships and knowledge to ensure that you avoid any unnecessary problems with taxes, tariffs or documentation

Altogether, Arcade can offer your brand unparalleled speed to market, a far smoother transition and more comprehensive support once we help you set everything up. If you’d like to find out more, feel free to get in touch at: https://www.arcade.global/contact-us/

[1] https://www.statista.com/statistics/281241/online-share-of-retail-trade-in-european-countries/

[3] https://www.statista.com/statistics/1232115/uk-shoppers-that-will-mostly-shop-online-by-category/

[4] https://www.retailgazette.co.uk/blog/2021/02/onbuy-enjoys-whopping-800-sales-growth-in-january/

[5] https://www.statista.com/topics/2333/e-commerce-in-the-united-kingdom/#dossierKeyfigures

[6] https://www.statista.com/statistics/275968/online-purchasing-penetration-in-great-britain/